Did you know that many of us can increase our paycheck on payday by checking that our tax withholding is correct?

What?! Yes! Your IRS tax withholding is something you control and can change at any time with your employer.

The sad thing is that most Americans don’t understand how their taxes work, let alone how to manage them properly to make their money work to their advantage.

Let me show you the easiest way to check if you can make more money on your next paycheck.

Do you like getting a significant tax return?

It is nearing the end of January, and resolutions and new goals are either set in full swing or have already been discarded.

Now, many employers are making W-2s available, supplying us with the information we need to file our taxes. Some of us are counting the days until we can file because we are expecting a BIG tax refund and planning all the great ways we can spend that money. Is this you?

How many of you answered that question with a firm “YES!” out loud and with emphasis (or you would have if you were reading this in a different location where you could)? If this is you, then keep reading.

I like to ask this question in a room full of people and have people raise their hands if they received over $1000 as a tax return last year. Many raise their hand with gusto to say, ‘I did, I won, I got all this money from the government!’ Then I say, “You know what I call you guys? Suckers!” (Not as an insult, in a joking, but pay attention way!)

You might be thinking the same thing as my audience was. ‘What?! Why would you say that?! I must have done something right because I got all this free money at the end of the year, didn’t I?!” Actually, if you got a lot of money on your tax return, you gave the government an interest-free loan on your money. I am not willing to do that. I have taken student loans from the government, and they charged me lots of interest. Why would I loan them my money at 0% interest??

A Tax Return is a Refund of Money you Shouldn’t Have Paid

How can this be? Well, a tax return is just that, a return. The government is returning the money you overpaid to them throughout the year, but they are not giving you any interest for the time they held it. But I guarantee, while holding it for months, they are investing it, paying off debt, or whatever they can do to make your money work for them while they have it! Wouldn’t you rather have your money so it can work for you??

If you are getting a refund of over $1500, you should check if you have been overpaying on your taxes. You can assess and change how much is being withheld from your paycheck anytime during the year. The IRS even supplies a calculator, so you can assess it accurately and based on IRS tax laws. You can make a general estimate on your own of what exemptions are appropriate to take, but be careful of doing it this way because what happens if you underpay and owe the government a lot of money at the end of the year? If you owe them thousands, they will charge you interest, fees, and penalties because of what they lost during the year.

This isn’t such a tragedy when your refund is only $1500. Maybe you will even get a refund of a few thousand when you paid little to no taxes due to your credits, BUT it is a tragedy when I see families getting over a $10,000 tax refund and at the same time accumulating over 20% interest on $40,000 of credit card debt during the year. If these families reduced what they paid in monthly taxes and paid some of that debt off, they could save themselves thousands of interest annually!

So, just what are tax exemptions?

Exemptions are allowances from the government that reduce how much of our income is taxed for the year. The easiest way to estimate how many to claim is to count how many mouths you must feed in your household.

Now, just because you are renting your house out to three friends does not mean you have four exemptions (you + 3 friends). To have the allowance of an exemption, you need to be supplying over half of that individual’s needs. Usually, your exemptions are only yourself, a spouse, and your children, but you will get extra allowances for certain things like filing as Head of Household and certain income ranges with children. Your taxable income is also reduced by using benefits such as putting money into an FSA (Flexible Spending Account) or claiming a Dependent Care Credit for child or adult care.

If you want to assess more accurately than just counting mouths, there are two good ways to do it.

(Update note 2023: Exemptions are no longer used for tax withholding. You fill out the W4 differently now. You can still estimate as indicated below.)

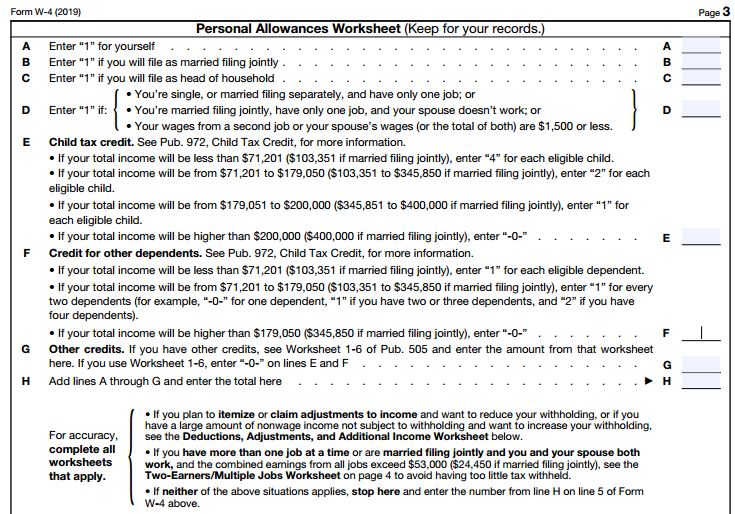

Use the Worksheets on the W4 form.

The W4 form can be downloaded on the IRS website. (It looks a little different now, 2023)

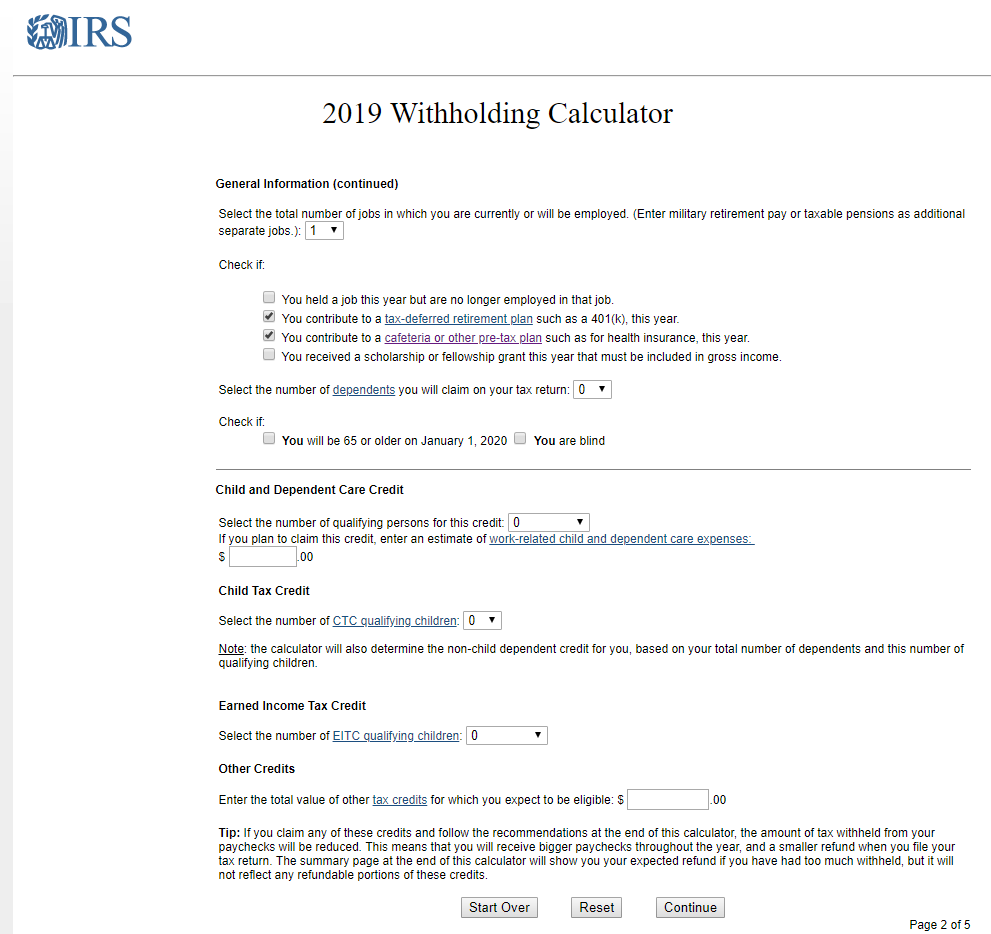

2. Use the Withholding Estimator on the IRS website

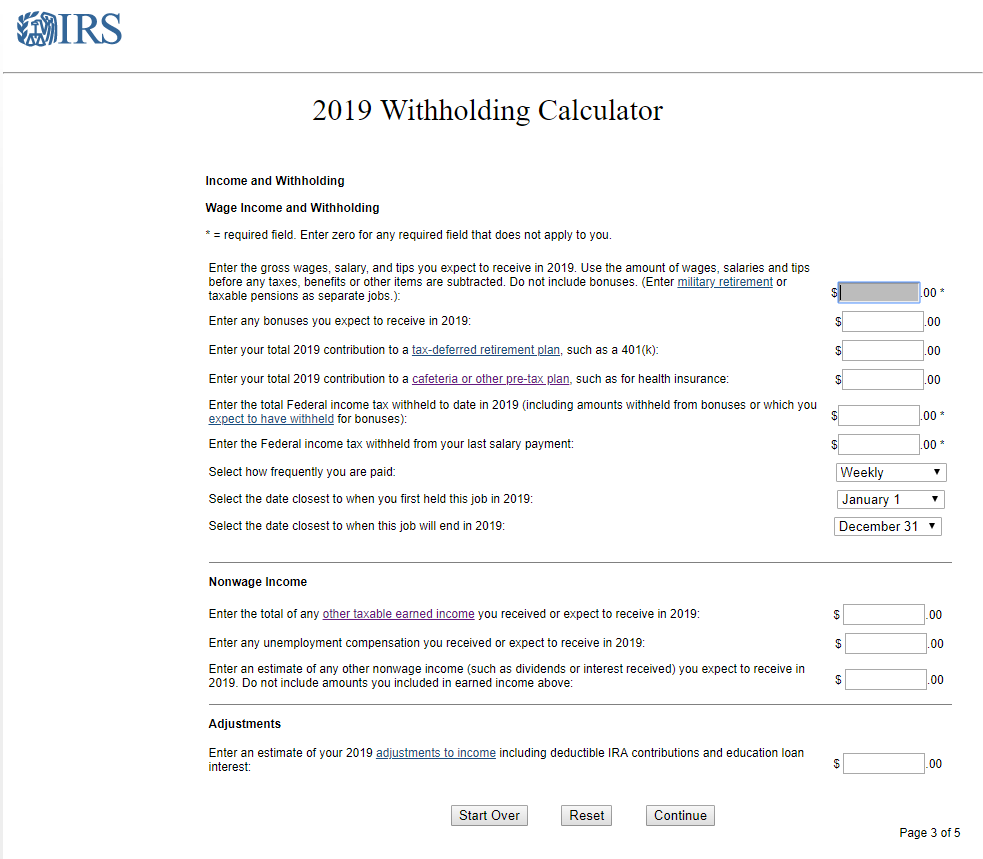

Get your last pay statement to help you with filling in the spaces. If it is near the beginning of a new year, you will have to wait until you have received at least one pay statement from your employer. Then you can enter your figures from the statement. If you are married, you will also need your spouse’s most recent pay statement from this year.

When using this calculator, be sure you understand what to input in the calculator. There are blue links that will give you more information about the figures that are asked for. You could always call someone from your HR department and ask them where you would find a specific figure on your pay stub.

- First, check any boxes that apply to you. If you put any of your money into a Traditional 401K or for the military, this would be TSP but don’t check this box if you put your money into a Roth. Check if you have money removed from your check as pre-tax to pay for things like insurance or FSA or HSA accounts.

- Second, include figures for any credits you should receive. Child tax credits and Earned Income Credits for the number of children you have and add up Dependent Care if you claim this credit or have money taken from your check for Dependent Care expenses. Remember, if you are divorced, only count the number of children you will be eligible to claim for the year you are figuring, both for the number of dependents and the number eligible for the credits.

- Third, continue to the next page and enter your figures from your pay statement. You may need a calculator to assist. For wages, multiply the gross listed on that pay statement by the number of pay statements you will receive that year. For the contributions, again multiply the amount in your deductions section by the number of times you are paid for the year (52 for weekly, 12 for monthly, 24 for bi-monthly, etc.). Use the drop-downs to indicate how you are paid or choose how many pay statements you will get. For example, the military is paid bi-monthly, but their LES is only calculated and supplied monthly, so the figures from their pay statements are split by 12 over the year.

- Hit continue and read what your estimates are for the year. The calculator will give you your estimated taxes for the year and how many exemptions you should claim to get you as close to even as possible.

- BEWARE: This calculator is only as accurate as the figures you put in them. If unsure what to enter, ask a financial professional for help.

Once you have your calculations submit them via a W4 tax form with your employer. Many have these readily available through your HR website, but if not contact the department and they will let you know how you can change your exemptions.

Your pay should be adjusted by the next paycheck or two! Hopefully, higher for every body!

Times You Should Adjust Your Tax Withholding

There are a few times that would trigger a reassessment of your claims and possibly be a reason to make changes; the birth or death of a household dependent, following a marriage or divorce, or when income into the household changes.

For military, or anyone working overseas, it would be good to assess exemptions if some of the income that year will be earned in a combat zone or be untaxable for another reason. Just keep in mind when filling out the calculator, only include income that is taxable.

Hopefully, after adjusting your tax withholding, you will increase your paycheck and have a little more money to save or use to pay down debts each month. This will reduce the return you will get at the end of the year, but the good thing is that now you don’t have to wait a year to get this money!

- Can You Bring an Inhaler on a Plane? Important Tips - February 5, 2024

- How Can I Hide Money From My Husband Before Our Divorce? - January 21, 2024

- Comprehensive Credit Card Forum Guide: Best 10 to Join - November 17, 2023

Leave a Reply